(Bloomberg) -- The monolithic dominance of Big Tech made life miserable for stock pickers in recent years. With the group reaching a double-digit drop from its peak, opportunities to uncover the next market vanguards have arisen, according to Morgan Stanley’s Lisa Shalett.

That means scouring balance sheets for companies that have solid earnings and should hold up if the economy slows or tariffs stoke inflation, the wealth management unit’s chief investment officer said in an interview.

Shalett sees “money to be made” in owning standouts within financial services, domestic industrials, energy and materials mining companies, as well as consumer services like media and entertainment. She also likes health care, one of last year’s worst laggards, pointing to interesting generative AI applications for the sector.

“We have to ask ourselves which companies are going to be able to sustain earnings momentum and which are not,” the CIO said. “It’s a very idiosyncratic market — one where stock picking matters a lot.”

Part of Shalett’s thesis is based on her January pronouncement that the biggest technology companies’ command of the stock market would come under the gun this year. That prediction is already starting to play out: less than a month ago, the AI assistant startup out of China, DeepSeek, jumped into the spotlight, casting doubts on US tech and its robust investment into AI technology.

She is the latest in a string of Wall Street pros urging investors to be more selective when making decisions, rather than buying broad swaths of the market. Citigroup Inc.’s trading desk recently espoused the strategy while asset manager Janus Henderson launched its first stock-picking ETF earlier this month. Bank of America Corp. strategists led by Savita Subramanian have called the current earnings cycle a “stock picker’s paradise.”

Another key bulwark responsible for the market’s bull run is also crumbling, Shalett says: namely, a bias at the Federal Reserve toward reducing borrowing costs as inflation stalls. Combine that with the fading dominance of megacap tech and it’s time to look for opportunities in other sectors.

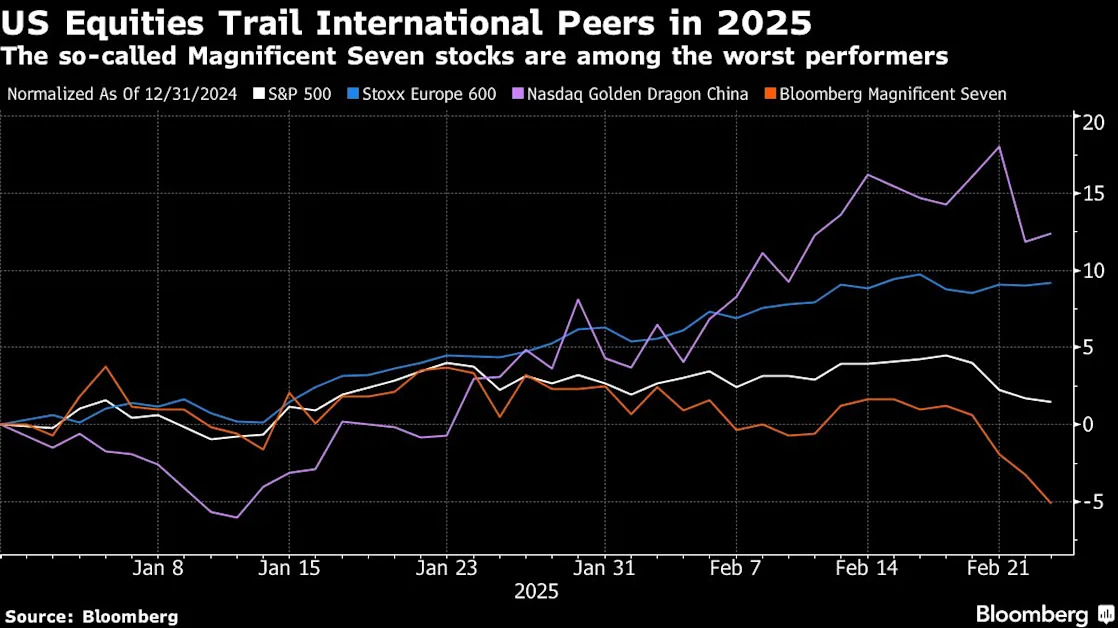

Already, signs of this shift are evident. The Bloomberg Magnificent 7 Index — a gauge that consists of Apple Inc., Nvidia Corp., Microsoft Corp., Alphabet Inc., Amazon.com Inc., Meta Platforms Inc. and Tesla Inc. — widened its loss from a December high to more than 10% on Tuesday, falling past the threshold that represents a correction. At the same time, last year’s underperformers, including consumer staples, health care, real estate and materials, are leading the S&P 500 Index’s leaderboard year to date. Only information technology and consumer discretionary sectors, previous winners, were down for the year as of Tuesday.

Most of the 2025 advance, according to Shalett, has come from retail investors stepping in to buy the dip because they’re accustomed to markets racing higher after any pullback. Indeed, US stock purchases by mom-and-pop investors hit the highest level in two years late last month, according to an analysis by JPMorgan Chase & Co. quantitative and derivatives strategist Emma Wu.

“We’re starting to, quote, unquote, ‘get real,’” Shalett said.

In her view, part of “getting real” is identifying companies that are generating earnings and signaling continued growth, while steering away from firms heavily exposed to consumer stress or changes around immigration policy. “This narrative of moving from a monetary policy and thematic market to a fiscal policy and earnings-driven market in our parlance means it’s a more normal market.”

Of course, finding the next stock winners is extremely difficult, as evidenced by years of underperformance by actively managed funds when compared to the broader market.

The next big hurdle for investors will be Nvidia’s high-stakes earnings after Wednesday’s close, and an update on the Fed’s preferred inflation measure: the so-called core personal consumption expenditures price index due Friday.

Meanwhile, worries have been compounding around how the new US administration’s policies will affect global growth and long-established economic and political alliances, driving investors into international markets. While the the S&P 500 is up less than 2% in 2025, an MSCI Index covering all countries except the US has rallied roughly 7%. European stock markets have soared to record highs.

“We’re not yet ready to call the move in Europe anything more than a trade,” Shalett said. “But geographic diversification is going to be key in these kinds of markets.”

Of all the risks that have been building up of late, markets failing to price in geopolitical uncertainty ranks highest for the CIO. Valuations remain expensive versus bonds despite the confrontational stance President Donald Trump and his office have taken against allies and rivals around the world, while wars plague Eastern Europe and the Middle East.

“The political jargon is that we have to make America great again, but from a capital markets perspective, America’s been pretty great for the past 15 years,” Shalett said. The issue is that American exceptionalism is premised on old institutional stability, she says, which is now being challenged by White House policies, signaling a potential geographical multi-generational shift.

“That reality is not being priced into the stock market at all,” she said.