Artificial intelligence (AI) software company C3.ai (NYSE:AI) reported Q4 CY2024 results topping the market’s revenue expectations , with sales up 26% year on year to $98.78 million. The company expects next quarter’s revenue to be around $108.6 million, close to analysts’ estimates. Its non-GAAP loss of $0.12 per share was 52% above analysts’ consensus estimates.

Is now the time to buy C3.ai? Find out in our full research report .

C3.ai (AI) Q4 CY2024 Highlights:

“In the third quarter, C3 AI achieved significant milestones — expanding our global distribution network, advancing our leadership in agentic and generative AI, and delivering total revenue reaching $98.8 million, up 26% year-over-year,” said Thomas M. Siebel, Chairman and CEO, C3 AI.

Company Overview

Founded in 2009 by enterprise software veteran Tom Seibel, C3.ai (NYSE:AI) provides software that makes it easy for organizations to add artificial intelligence technology to their applications.

Data Infrastructure

Generating insights from system level data is an increasing priority for most businesses, but to do so requires connecting and analyzing piles of data stored and siloed in separate databases. This is the demand driver for cloud based data infrastructure software providers, who can more readily integrate, distribute and process information vs. legacy on-premise software providers.

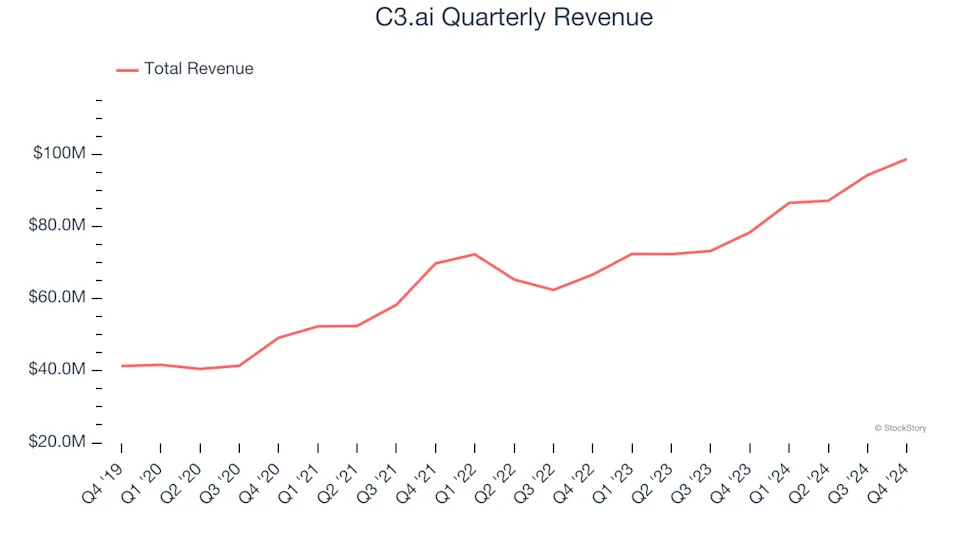

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, C3.ai grew its sales at a 16.4% annual rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the software sector, which enjoys a number of secular tailwinds.

This quarter, C3.ai reported robust year-on-year revenue growth of 26%, and its $98.78 million of revenue topped Wall Street estimates by 0.5%. Company management is currently guiding for a 25.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 22.3% over the next 12 months, an acceleration versus the last three years. This projection is admirable and indicates its newer products and services will spur better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. .

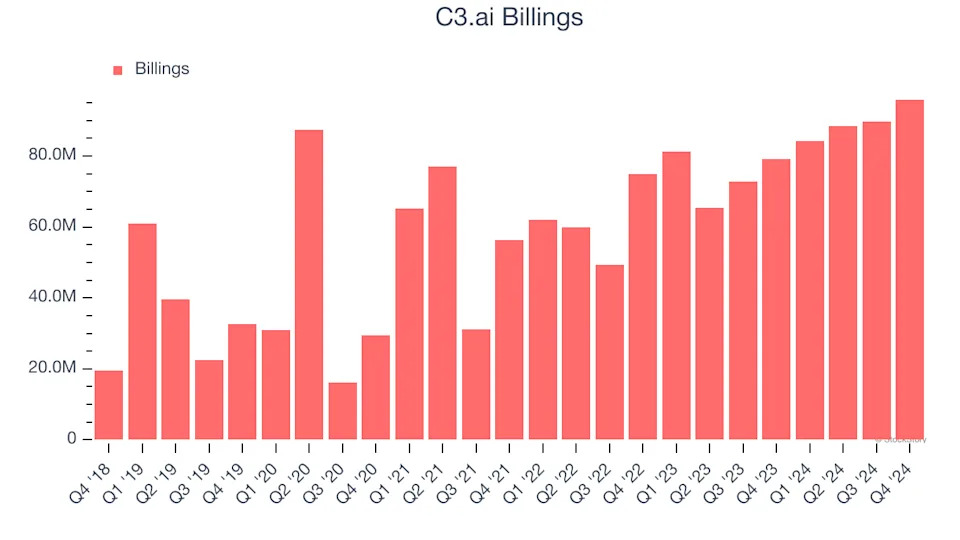

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

C3.ai’s billings punched in at $95.95 million in Q4, and over the last four quarters, its growth was impressive as it averaged 20.9% year-on-year increases. This alternate topline metric grew slower than total sales, meaning the company recognizes revenue faster than it collects cash - a headwind for its liquidity that could also signal a slowdown in future revenue growth.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

It’s very expensive for C3.ai to acquire new customers as its CAC payback period checked in at 160.9 months this quarter. The company’s slow recovery of its sales and marketing expenses indicates it operates in a highly competitive market and must invest to stand out, even if the return on that investment is low.

Key Takeaways from C3.ai’s Q4 Results

We struggled to find many resounding positives in these results that would assure a jittery market. Its billings missed significantly and its revenue beat by a very small amount, likely not enough in this market. Looking ahead, revenue guidance for next quarter was just in line with Wall Street’s estimates. Again, this likely isn't enough for a market looking for strong results from tech and AI-linked companies. The stock traded down 5.9% to $24.90 immediately after reporting.

C3.ai’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .