Online legal service provider LegalZoom (NASDAQ:LZ) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, with sales up 1.9% year on year to $161.7 million. Guidance for next quarter’s revenue was better than expected at $177 million at the midpoint, 1% above analysts’ estimates. Its GAAP profit of $0.07 per share was in line with analysts’ consensus estimates.

Is now the time to buy LegalZoom? Find out in our full research report .

LegalZoom (LZ) Q4 CY2024 Highlights:

“We are making solid progress against our goal to position LegalZoom for long-term, sustainable growth,” said Jeff Stibel, Chairman and Chief Executive Officer of LegalZoom.

Company Overview

Founded by famous lawyer Robert Shapiro, LegalZoom (NASDAQ:LZ) offers online legal services and documentation assistance for individuals and businesses.

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

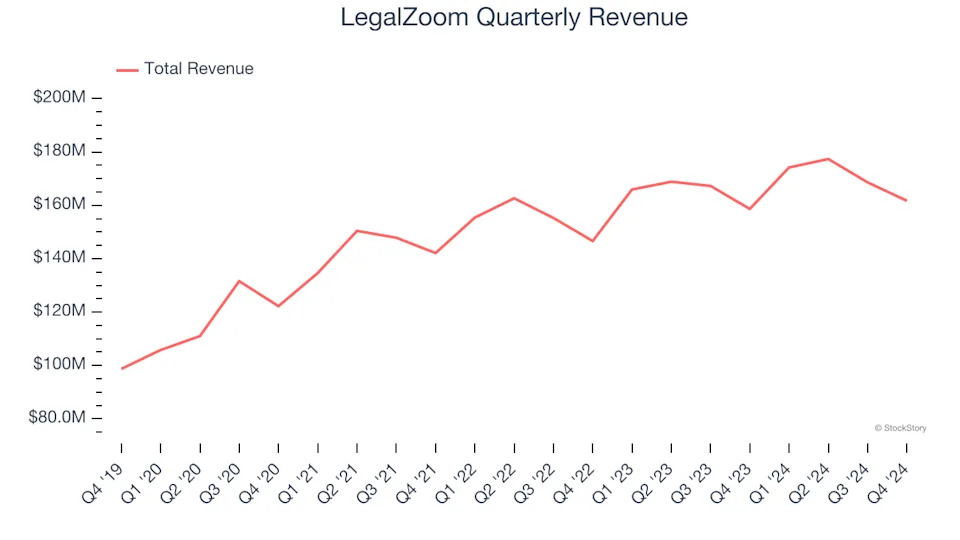

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, LegalZoom’s 5.8% annualized revenue growth over the last three years was sluggish. This fell short of our benchmark for the consumer internet sector and is a tough starting point for our analysis.

This quarter, LegalZoom reported modest year-on-year revenue growth of 1.9% but beat Wall Street’s estimates by 0.6%. Company management is currently guiding for a 1.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 1.9% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and suggests its products and services will see some demand headwinds.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. .

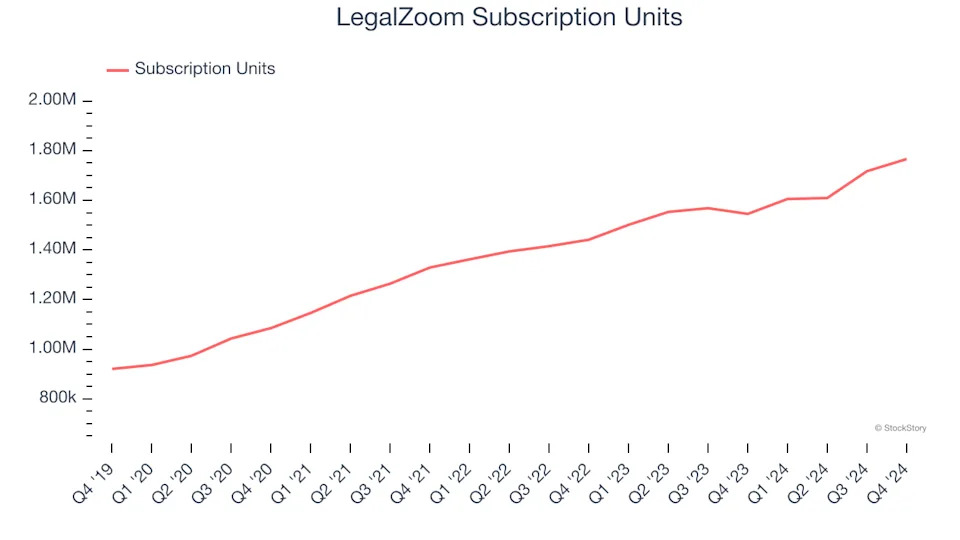

Subscription Units

User Growth

As an online marketplace, LegalZoom generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

Over the last two years, LegalZoom’s subscription units, a key performance metric for the company, increased by 9.2% annually to 1.77 million in the latest quarter. This growth rate is solid for a consumer internet business and indicates people are excited about its offerings.

In Q4, LegalZoom added 221,000 subscription units, leading to 14.3% year-on-year growth. The quarterly print was higher than its two-year result, suggesting its new initiatives are accelerating user growth.

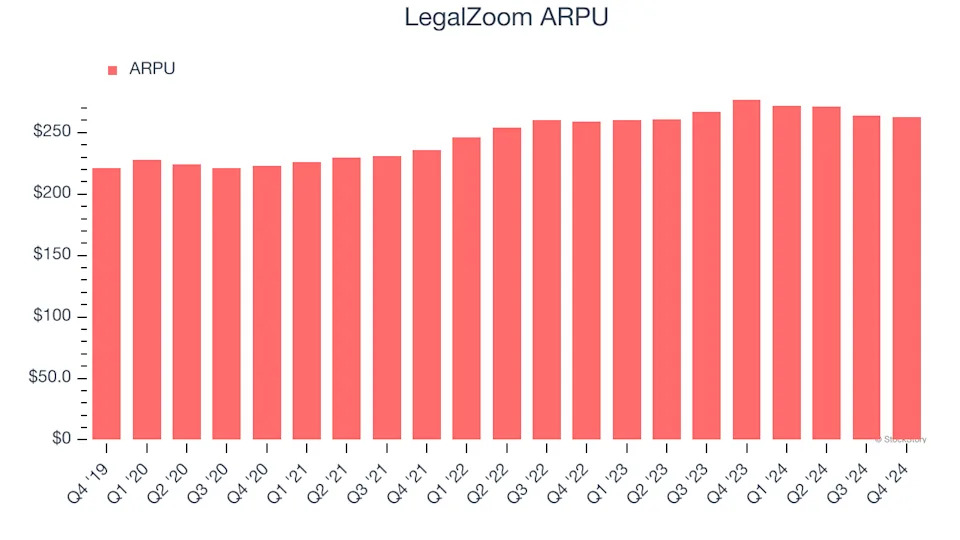

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track for online marketplace businesses like LegalZoom because it measures how much the company earns in transaction fees from each user. ARPU also gives us unique insights into a user’s average order size and LegalZoom’s take rate, or "cut", on each order.

LegalZoom’s ARPU growth has been subpar over the last two years, averaging 2.5%. This isn’t great, but the increase in subscription units is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if LegalZoom tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether users can continue growing at the current pace.

This quarter, LegalZoom’s ARPU clocked in at $263. It declined 5.1% year on year, worse than the change in its subscription units.

Key Takeaways from LegalZoom’s Q4 Results

It was great to see LegalZoom’s EBITDA guidance for next quarter top analysts’ expectations. We were also happy its number of subscription units outperformed Wall Street’s estimates. Looking ahead, there was more good news with guidance, as both revenue and EBITDA guidance for next quarter exceeded expectations. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 7.2% to $9.50 immediately after reporting.

LegalZoom may have had a good quarter, but does that mean you should invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free .