Leading edge card issuer Marqeta (NASDAQ: MQ) beat Wall Street’s revenue expectations in Q4 CY2024, with sales up 14.3% year on year to $135.8 million. Guidance for next quarter’s revenue was better than expected at $135.7 million at the midpoint, 1.7% above analysts’ estimates. Its GAAP loss of $0.05 per share was in line with analysts’ consensus estimates.

Is now the time to buy Marqeta? Find out in our full research report .

Marqeta (MQ) Q4 CY2024 Highlights:

"In 2024, we empowered our customers to achieve significant growth and scale, maintaining both stability and compliance," said Mike Milotich, Interim CEO at Marqeta.

Company Overview

Founded by CEO Jason Gardner in 2009, Marqeta (NASDAQ:MQ) is an innovative card issuer that provides companies with the ability to issue and process virtual, physical, and tokenized credit and debit cards.

Payments Software

Consumers want the ability to make payments whenever and wherever they prefer – and to do so without having to worry about fraud or other security threats. However, building payments infrastructure from scratch is extremely resource-intensive for engineering teams. That drives demand for payments platforms that are easy to integrate into consumer applications and websites.

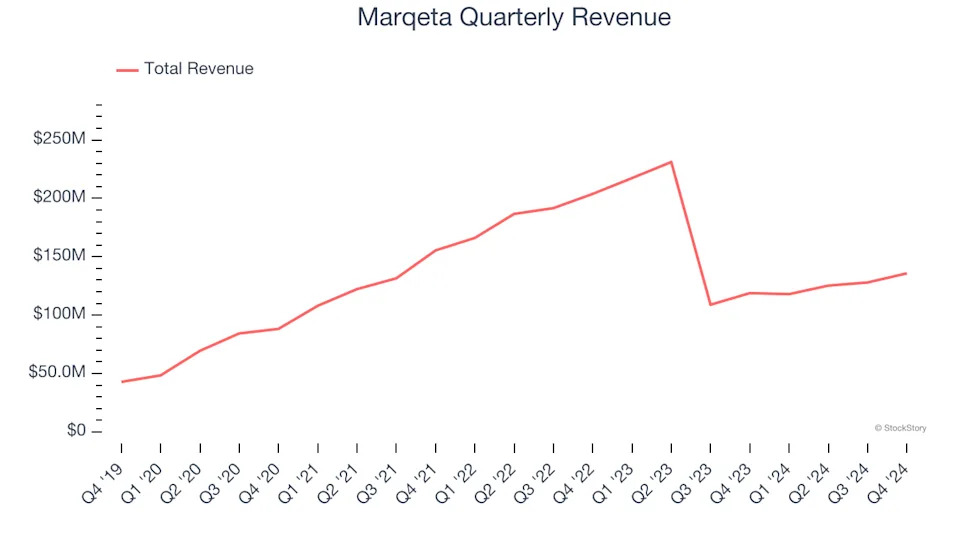

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Marqeta struggled to consistently increase demand as its $507 million of sales for the trailing 12 months was close to its revenue three years ago. This wasn’t a great result, but there are still things to like about Marqeta.

This quarter, Marqeta reported year-on-year revenue growth of 14.3%, and its $135.8 million of revenue exceeded Wall Street’s estimates by 3%. Company management is currently guiding for a 15% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 15% over the next 12 months, an acceleration versus the last three years. This projection is healthy and indicates its newer products and services will spur better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. .

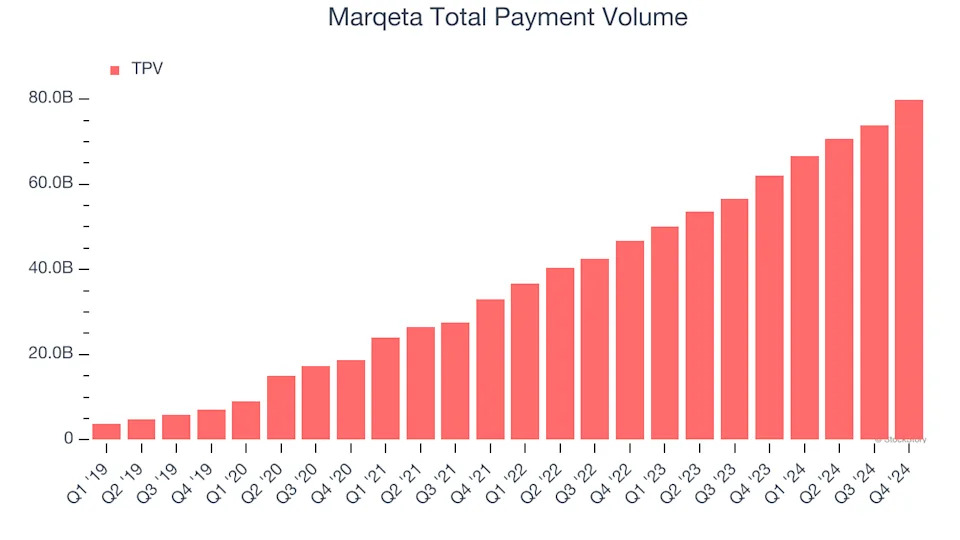

Total Payment Volume

TPV, or total processing volume, is the aggregate dollar value of transactions flowing through Marqeta’s platform. This is the number from which the company will ultimately collect fees, and the higher it is, the more chances Marqeta has to upsell additional services (like banking).

Marqeta’s TPV punched in at $79.91 billion in Q4, and over the last four quarters, its growth was fantastic as it averaged 31.1% year-on-year increases. This alternate topline metric grew faster than total sales, which could mean that take rates have declined. However, we can’t automatically assume the company is reducing its fees because take rates can also vary depending on the type of products sold on its platform.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Marqeta’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a competitive market and must continue investing to grow.

Key Takeaways from Marqeta’s Q4 Results

Marqeta beat analysts’ operating profit expectations handily this quarter. We were also glad its total payment volume outperformed Wall Street’s estimates. Finally, revenue guidance for next quarter exceeded expectations. Zooming out, we think this was a good quarter with some key areas of upside. The stock traded up 12.2% to $3.91 immediately after reporting.

Indeed, Marqeta had a rock-solid quarterly earnings result, but is this stock a good investment here? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .