By David Lawder and Andrea Shalal

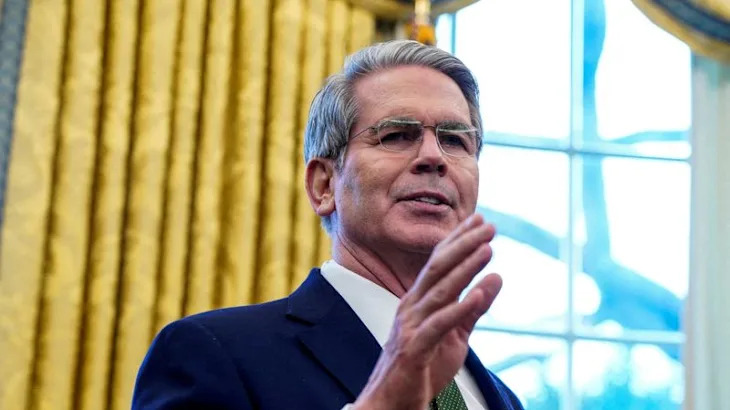

WASHINGTON (Reuters) -U.S. Treasury Secretary Scott Bessent on Tuesday argued the U.S. economy is more fragile under the surface than economic metrics suggest and vowed to "re-privatize" growth by cutting government spending and regulation.

In his first major economic policy address since taking office, Bessent said that interest rate volatility, sticky inflation and reliance on the public sector for job growth have hobbled the U.S. economy despite positive top-line GDP growth and low unemployment.

In the wide-ranging speech at an investment conference hosted by the Australian embassy in Washington, Bessent blamed "prolific overspending" under former President Joe Biden and regulations that have hindered supply-side growth as the main drivers of "sticky inflation."

"The previous administration's over-reliance on excessive government spending and overbearing regulation left us with an economy that may have exhibited some reasonable metrics but ultimately was brittle underneath, and heading for an unstable equilibrium" he said.

U.S. GDP output grew at a 2.8% rate in 2024, a hair slower than the 2.9% in 2023 and defying two years of Federal Reserve rate hikes for an economy that Fed Chair Jerome Powell this month described as "strong overall."

While job growth slowed in January, a low 4.0% unemployment rate is likely to extend the Fed's pause on rate hikes for now.

Bessent said that 95% of all job growth in the past 12 months has been concentrated in public and government-adjacent sectors such as health care and education, jobs offering slower wage growth and less productivity than private-sector jobs.

Meanwhile, he said jobs in manufacturing, metals, mining and information technology all contracted or flatlined over the same period.

"The private sector has been in recession," Bessent said. "Our goal is to re-privatize the economy."

Bessent said President Donald Trump's administration was working to bolster the private sector's contribution to job creation, partly by slashing regulations, extending tax cuts and rebalancing the U.S. economy through tariff policies.

SPENDING DISTORTIONS

"Government overspending brings distortions in the economy that inhibit dynamism and limit thrill to a designated subset of favored sectors," Bessent said.

But he added that the informal Department of Government Efficiency, led by billionaire entrepreneur Elon Musk, was about making government more efficient and was not "the department of government elimination."

Trump during his first term presided over the highest annual U.S. budget deficit of $3.13 trillion in fiscal 2020 due to massive COVID-19 relief spending. Deficits fell for Biden's first two years, but began climbing again, reaching $1.83 trillion in fiscal 2024 as interest on the federal debt exceeded $1 trillion.

Bessent said that Trump's economic agenda would help bring down interest rates, particularly on the benchmark 10-year Treasury note, by restoring market confidence in the long-term U.S. fiscal profile. He added that increased energy production and deregulation will help to bring down inflation by boosting supply.

He said the Treasury's current debt issuance plans leave the Treasury "well positioned" to address expected borrowing needs for the next several quarters while the administration works to "fix the core issues" of the U.S. economy.

TARIFF GOALS

Bessent said Trump's planned tariffs were an essential part of this effort, with three main goals.

"First, tariffs can increase U.S. industrial capacity, create and protect U.S. jobs, and improve our national security, he said. "Second, tariffs can be an important source of government revenue, which can help fund investments that benefit American families and companies."

He also cited it as a tool to correct and manage internal imbalances in other economies, and deter excess production and supply from other countries, such as China. He said that China could not be allowed to export deflation to major Western economies as it struggles with its own internal economic problems.

"China really needs more consumption," he said.

In deciding on reciprocal tariff rates, Trump's administration, including the Treasury, will examine a wide range of factors, including other countries' tariff rates, non-tariff barriers and currency practices, Bessent said.

Asked about how Australia, which has a U.S. free-trade agreement, was doing in this regard, Bessent said, "so far, so good, but I'm not USTR." The U.S. had a $17.9 billion goods trade surplus with Australia in 2024, according to Census Bureau data.

He said he discussed Australia's request to be exempted from Trump's restored 25% global steel and aluminum tariffs during a meeting with Australian Treasurer Jim Chalmers. He added however that that was a matter for the Commerce Department and USTR to decide.