Donald Trump's call to exempt Social Security benefits from income taxes may offer an alluring political sound bite.

But the move would undermine not just one critical safety net for seniors, but two.

Trump’s plan is expected to exhaust the reserve funds for both Social Security and Medicare faster than anticipated, according to tax policy experts.

That would saddle seniors with an even bigger cut in Social Security benefits than currently estimated and throw a healthcare program that covers 67 million into chaos. Taxes on Social Security payouts help fund Medicare’s hospital coverage.

The plan would also add $1.6 trillion over 10 years to the country's budget deficit with few economic gains, these experts said.

"It's not setting the entitlements up for success and it's not putting our budget in a good position," Garrett Watson, a senior policy analyst and modeling manager at the nonpartisan Tax Foundation, told Yahoo Finance.

The proposal has both the Tax Foundation and the Center for American Progress, which often are on opposite sides of tax policy, warning of the potential consequences.

"If smart analysts on the left and smart analysts on the right of the tax policy don't think it's a good idea, that certainly tells you something," Brendan Duke, senior director for economic policy at the left-leaning Center for American Progress Action Fund, told Yahoo Finance.

"It's probably not a good idea."

'Bottom half are losers'

Trump, the Republican presidential candidate, first floated the idea late last month at a rally in Harrisburg, Pa., vowing that "seniors should not pay taxes on Social Security and they won't," without offering further details.

On Wednesday, Trump stood by a banner that read "No tax on Social Security" at a campaign rally in Asheville, N.C., calling the tax a "cruel double taxation."

As it stands now, about 40% of seniors must pay federal income taxes on their Social Security benefits. The tax is progressive, meaning those with the lowest incomes aren't taxed, while wealthier seniors with substantial income outside of their benefits are.

Exempting benefits from income taxes would provide an effective 44% benefit increase for seniors with the highest incomes, a 6% increase for middle-income ones, and no increase for most in the bottom half, according to Marc Goldwein , a senior policy director for the Committee for a Responsible Federal Budget.

That's before Social Security runs into trouble.

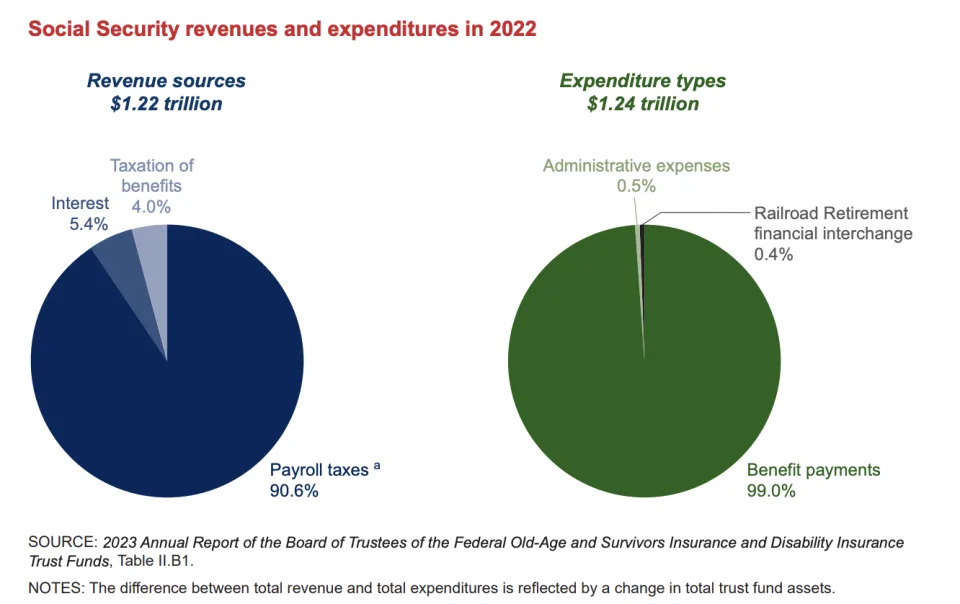

The tax seniors pay on their Social Security benefits also goes directly into funding the trust fund that supports the social program. Eliminating those taxes accelerates when the reserves for Social Security run out.

Currently, Social Security's reserves are expected to be exhausted by 2035, at which point benefits will get cut by 21%. If Trump's proposal is enacted, those reserves are estimated to run dry by 2033 and benefits would be slashed by 25%.

Even with the benefits cut, wealthier seniors come out slightly ahead with the tax break, pocketing a 9% increase, per Goldwein.

That's not the case for lower-earning Social Security beneficiaries who would see their benefits reduced by a quarter with no tax break.

"The bottom half are losers," Watson said.

Overall, the plan would water down what is considered the biggest anti-poverty program in the United States.

"There is no world where this does not increase the elderly poverty rate," Duke said.

'That's actually pretty scary'

Trump's plan would also empty out the reserves that Medicare uses for hospital coverage — known as Medicare Part A — sooner than anticipated.

Right now, that fund is expected to run out in 2036. That moves up to 2030 under Trump's plan, according to Watson.

The Medicare trustees have said the fund's insolvency could first cause delays in payments to health plans and providers of hospital services. Additionally, seniors' "access to health care services could rapidly be curtailed."

"Nobody actually knows what happens when Medicare runs out of money," Duke said. "And that's actually pretty scary."

'Mechanically add to the budget deficit'

The implications for the federal deficit are also sizable.

Not taxing seniors' benefits means $1.6 trillion in total revenue would not go to the trust funds that support Social Security and Medicare from 2024 to 2033, according to calculations using data from the most recent Social Security and Medicare trustees reports.

"This would mechanically add to the budget deficit and go in the wrong direction in solving that problem," Watson added.

There would be very little economic return from the proposal, too, Watson found.

The country's long-run gross domestic product would increase by 0.1%, while the economy would add around 64,000 full-time jobs. Wages would tick up by less than 0.05%.

"The intent [of the proposal] is trying to protect seniors who are operating on fixed incomes from inflation and provide more relief by not taxing it," Watson said. "But if it's done without offsets, it weakens the very entitlements they're trying to protect."

—

@JannaHerron .