Home healthcare provider Addus HomeCare (NASDAQ:ADUS) reported Q4 CY2024 results beating Wall Street’s revenue expectations , with sales up 7.5% year on year to $297.1 million. Its non-GAAP profit of $1.38 per share was 1.6% above analysts’ consensus estimates.

Is now the time to buy Addus HomeCare? Find out in our full research report .

Addus HomeCare (ADUS) Q4 CY2024 Highlights:

Commenting on the results, Dirk Allison, Chairman and Chief Executive Officer, said, “Our fourth quarter financial and operating performance marked a strong finish to another successful year for Addus. We achieved top-line revenue growth of 7.5%, and adjusted EBITDA was 10.3% higher for the fourth quarter of 2024 compared with the same period last year. For the year, revenues were up 9.1% to reach $1.15 billion, a new annual high for Addus. These results reflect robust demand for our home-based care services and our ability to meet this demand with our proven operating model across the care continuum."

Company Overview

Founded in 1979, Addus HomeCare (NASDAQ:ADUS) provides personal care services, hospice care, and home health services aimed at supporting individuals with daily living activities, chronic condition management, and end-of-life care.

Senior Health, Home Health & Hospice

The senior health, home care, and hospice care industries provide essential services to aging populations and patients with chronic or terminal conditions. These companies benefit from stable, recurring revenue driven by relationships with patients and families that can extend many months or even years. However, the labor-intensive nature of the business makes it vulnerable to rising labor costs and staffing shortages, while profitability is constrained by reimbursement rates from Medicare, Medicaid, and private insurers. Looking ahead, the industry is positioned for tailwinds from an aging population, increasing chronic disease prevalence, and a growing preference for personalized in-home care. Advancements in remote monitoring and telehealth are expected to enhance efficiency and care delivery. However, headwinds such as labor shortages, wage inflation, and regulatory uncertainty around reimbursement could pose challenges. Investments in digitization and technology-driven care will be critical for long-term success.

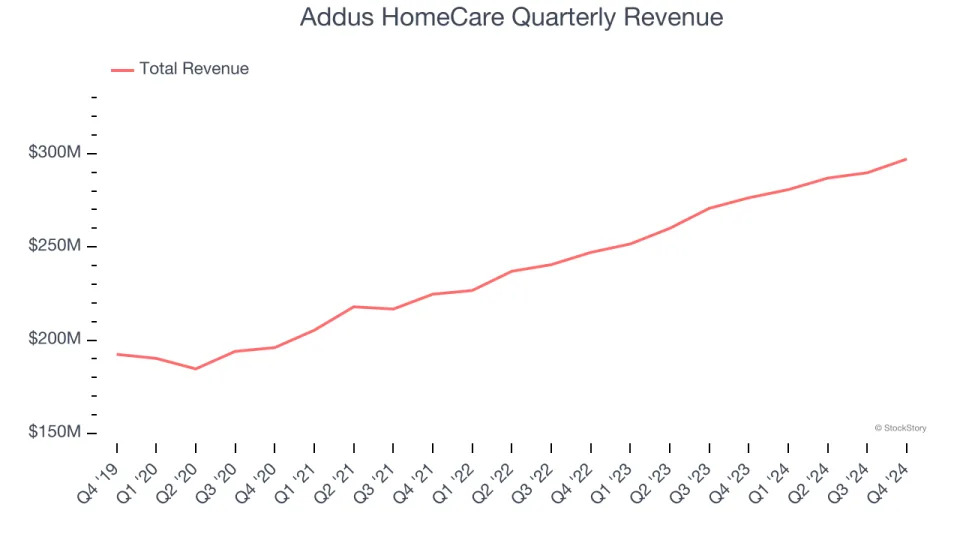

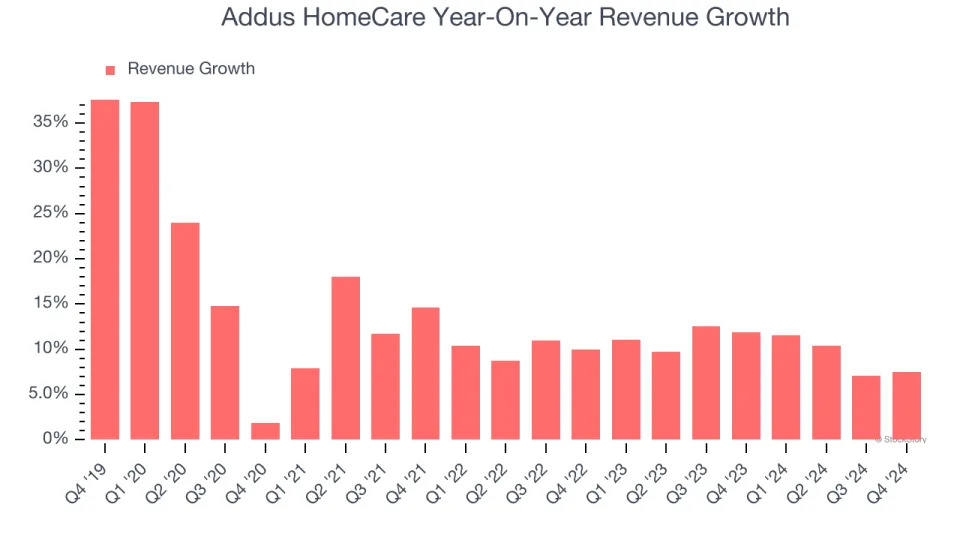

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Addus HomeCare’s sales grew at a solid 12.2% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Addus HomeCare’s annualized revenue growth of 10.2% over the last two years is below its five-year trend, but we still think the results were respectable.

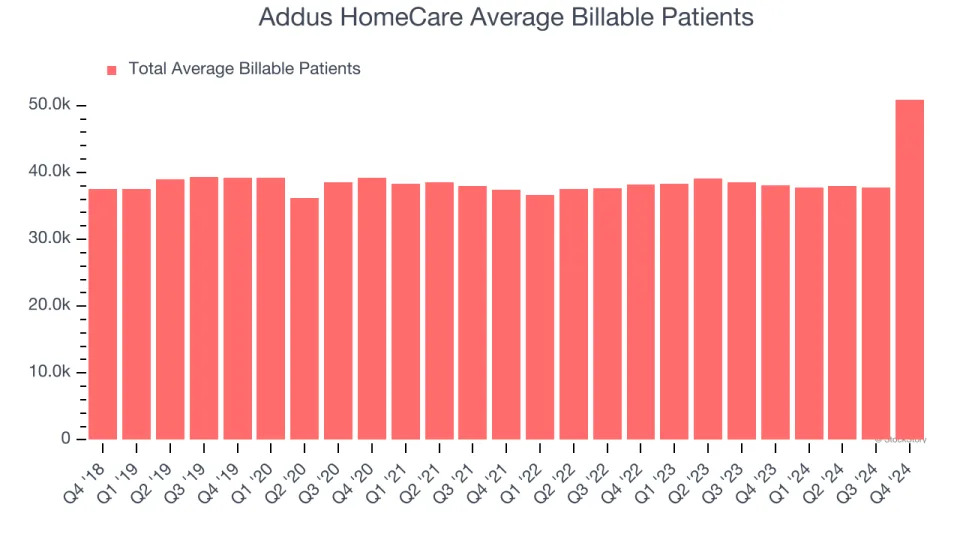

Addus HomeCare also reports its number of average billable patients, which reached 50,923 in the latest quarter. Over the last two years, Addus HomeCare’s average billable patients averaged 4.8% year-on-year growth. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Addus HomeCare reported year-on-year revenue growth of 7.5%, and its $297.1 million of revenue exceeded Wall Street’s estimates by 2.7%.

Looking ahead, sell-side analysts expect revenue to grow 23.7% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and suggests its newer products and services will fuel better top-line performance.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next .

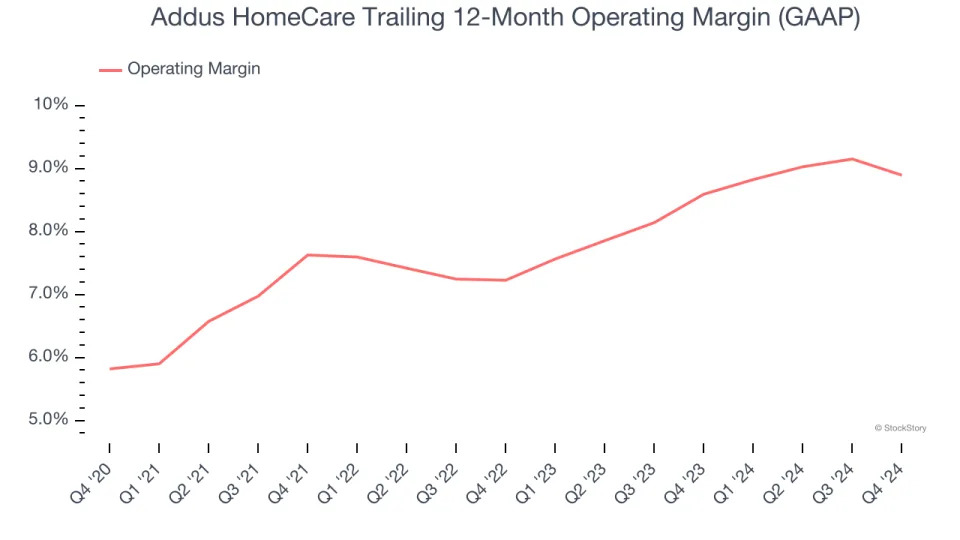

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Addus HomeCare was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.8% was weak for a healthcare business.

On the plus side, Addus HomeCare’s operating margin rose by 3.1 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 1.7 percentage points on a two-year basis.

In Q4, Addus HomeCare generated an operating profit margin of 9.1%, down 1.1 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

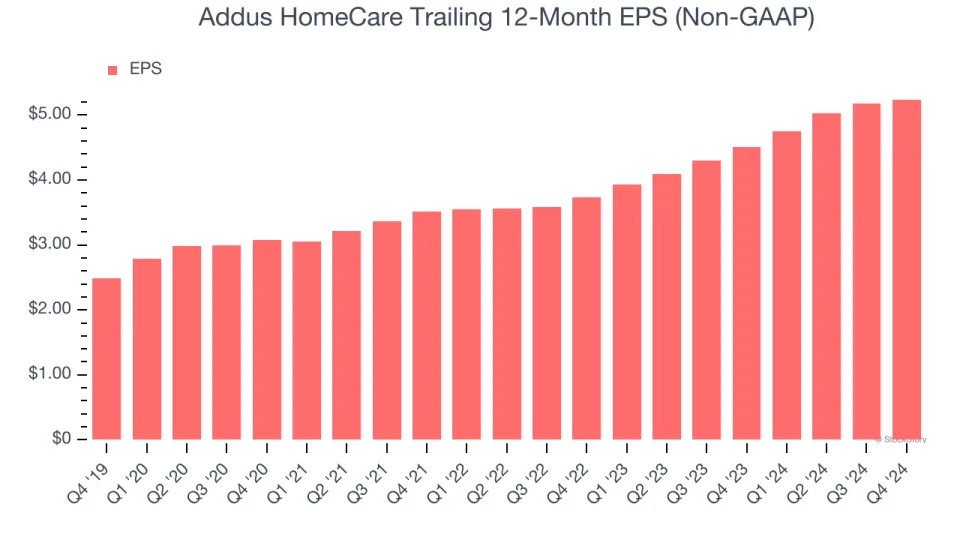

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Addus HomeCare’s EPS grew at an astounding 16% compounded annual growth rate over the last five years, higher than its 12.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Addus HomeCare’s earnings to better understand the drivers of its performance. As we mentioned earlier, Addus HomeCare’s operating margin declined this quarter but expanded by 3.1 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Addus HomeCare reported EPS at $1.38, up from $1.32 in the same quarter last year. This print beat analysts’ estimates by 1.6%. Over the next 12 months, Wall Street expects Addus HomeCare’s full-year EPS of $5.24 to grow 15.6%.

Key Takeaways from Addus HomeCare’s Q4 Results

We were impressed by how significantly Addus HomeCare blew past analysts’ billable patient expectations this quarter. We were also glad its revenue, EPS, and EBITDA outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock remained flat at $108.82 immediately following the results.

Addus HomeCare put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free .