US stocks edged mostly higher Wednesday as Wall Street embraced another encouraging signal on consumer prices that is set to help shape the near-term future of interest-rate policy. The S&P 500 ( ^GSPC ) rose 0.4%, while the tech-heavy Nasdaq Composite ( ^IXIC ) finished just above the flatline. The Dow Jones Industrial Average ( ^DJI ) gained 0.6%, or more than 200 points.

The Consumer Price Index (CPI) showed price increases held largely steady in July. Consumer prices rose 2.9% year-over-year in July, the first time headline inflation has dipped below 3% since 2021. On a "core" basis, stripping out costs of food and energy, prices rose 3.2% year over year. Both numbers largely met Wall Street forecasts.

Wall Street had rallied Tuesday on the back of positive inflation data that could foreshadow a similar direction in consumer prices. The Producer Price Index, which measures wholesale inflation in the US economy, rose just 2.2% year-over-year in July, nearly in line with the Federal Reserve's 2% target.

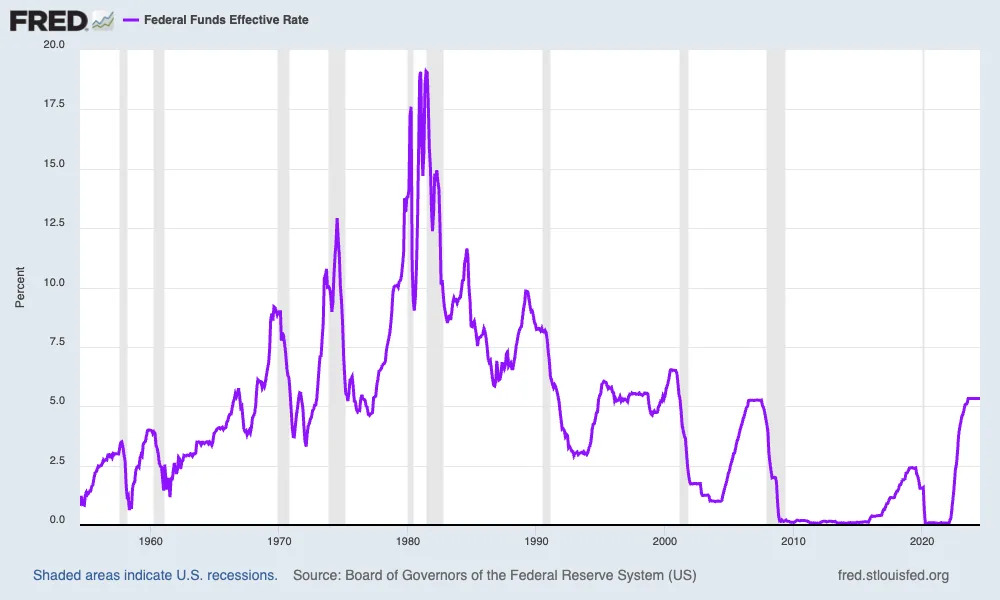

Together, the inflation signals could get the Fed closer to a rate cut. Even the most hawkish members of the Fed are signaling they need just a bit more good data to be ready to support an interest rate cut. More signs of cooling inflation, combined with a cooling job market, would likely leave the Fed positioned for a rate cut at its September meeting.

According to the CME FedWatch tool, traders are aligned on a Fed cut next month — the question is by how much. Around 36% of bets are on a bigger, 50 basis point cut, while the rest remain on a 25-point cut.