(Bloomberg) -- Takeover bids and activist intervention are shoring up shares of some Japanese companies seen as having weak fundamentals, making it harder for investors to succeed in short-selling strategies.

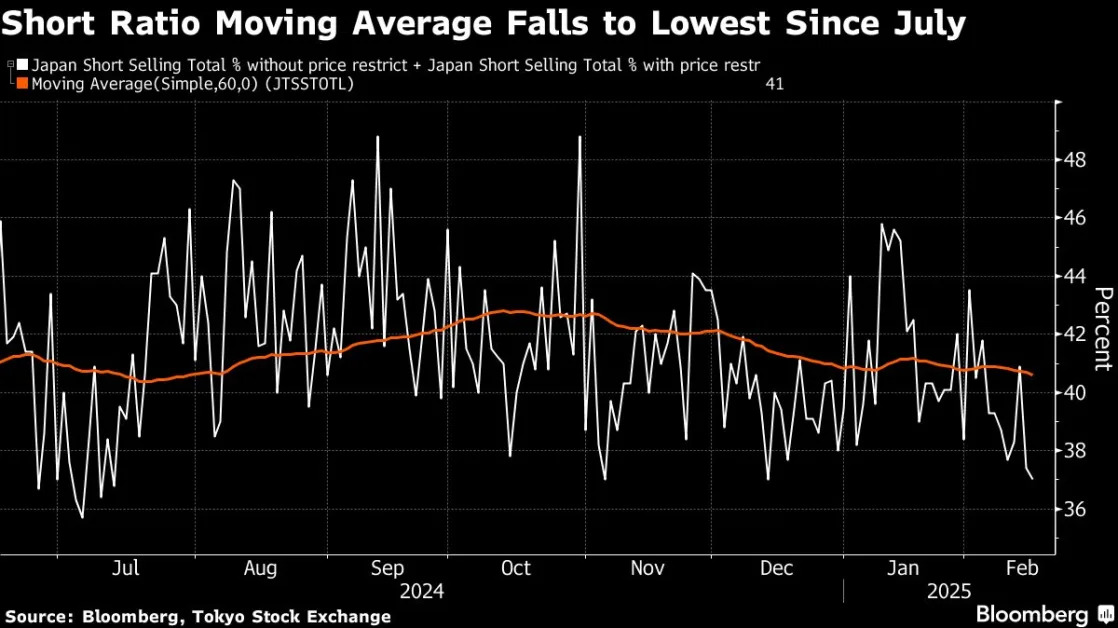

Hints of the difficulty are starting to show in trading data. Japan’s percentage of short-selling to total trades is at the lowest since July last year, in terms of the 60-day moving average.

With mergers and acquisitions reaching a record of more than $230 billion last year in the country, and activists exerting greater influence on corporate Japan, investors from Sparx Asset Management to UBP Investments Co. and Sigmoid Capital are becoming warier of non-earnings factors that may boost shares.

“Even when I expect shares to fall, depending on their financial condition or shareholder structure they still could be a target,” said Takuya Haruo, a fund manager at Sparx Asset Management,. “I cannot call it before it happens but I need to take into account the possibility.”

Haruo, who oversees the Sparx Japan Equity Long Short Fund, closed two out of three short positions on automakers after plans to combine Honda Motor Co. and Nissan Motor Co. came out in December. While they have since called off talks, a surge in M&As has Haruo scrutinizing the financial positions and shareholder structures of short targets.

The changing landscape also prompted Zuhair Khan, a fund manager at UBP Investments, to avoid shorting cash-heavy companies and real estate-rich firms that may become targets for activist investors. His previous strategy consisted of taking short positions betting that shares would fall once activist proposals failed.

Khan is now going long on companies that he thinks are likely to be taken over. Three of his long positions over the past seven months were the targets of takeover bids, amid growing pressure from the economic ministry and the Tokyo Stock Exchange to boost shareholder value.

“There’s been dynamic changes in governance,” said Khan, who oversees $76 million in investments focused on whether companies are managed properly. “All of that has definitely had an impact on how and which stocks we select to go long and short.”

The fund manager is maintaining his portfolio’s short exposure as he remains ready to short companies left with high valuations after Japan’s equity market surged more than 40% over the past two years. Firms that hold low profit margin businesses are also targets to sell, he said.

Sparx’s Haruo is still looking for opportunities to sell overvalued blue-chip stocks. Meanwhile, he has built a stake in Seven & i Holdings Co. for its fundamentals and prospects the shares will rise regardless of whether the takeover bid by Alimentation Couche-Tard Inc. or the competing plan by the company’s management succeeds. He said his net exposure — the difference between a fund’s long positions and its short positions — will be maintained at about 30%.

Equity ownership of management and a company’s operational track record are factors to look at when picking shorts, said Wendy Chen, founder and chief investment officer of Sigmoid Capital. Her fund avoids shorting automakers because of their low price-to-book ratio, which tends to attract activists.

But non-fundamental factors are not unique to Japan, according to Chen, who manages $100 million in fund assets.

“If you compare Japan to its own history, it was simpler before and now there’s this additional factor you have to consider,” Chen said. “There’s always some sort of non-fundamental factors in each of market.”

For Japan, those factors include buybacks and other corporate actions, said Masanari Takada, a quantitative and derivatives strategist at JPMorgan Securities Japan Co. That makes it harder to choose the right short, he said.

“If there are stocks that look promising in the long term, I think it’s a good idea to go long, but the question of what to short always comes up,” Takada said. “There remains the possibility of long-short strategies becoming quite difficult to manage.”

--With assistance from Joanne Wong, Yasutaka Tamura and Alice French.