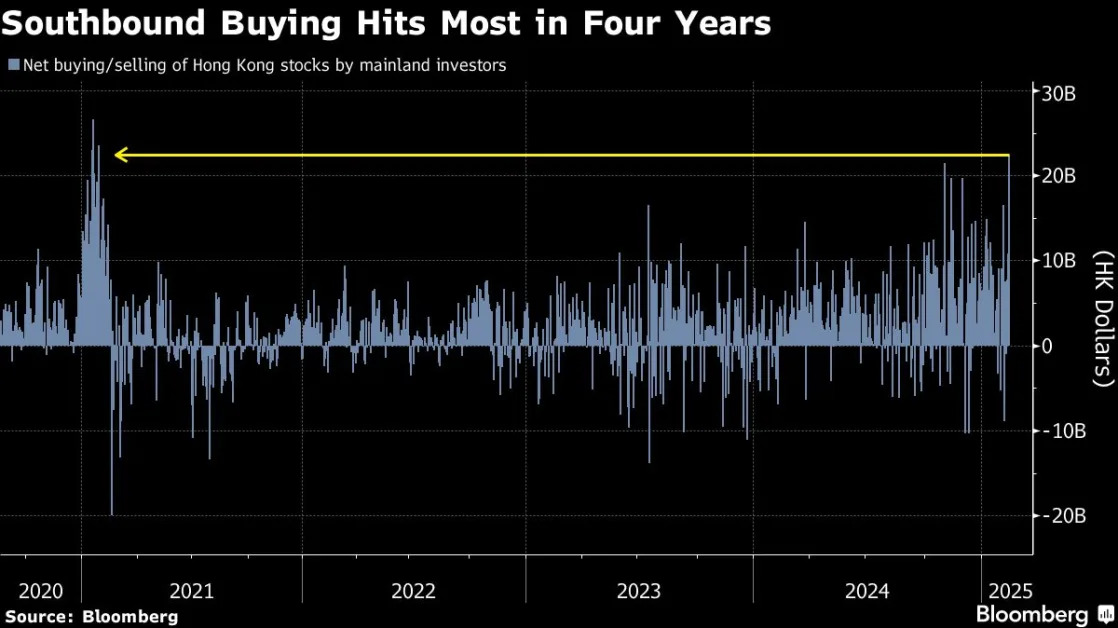

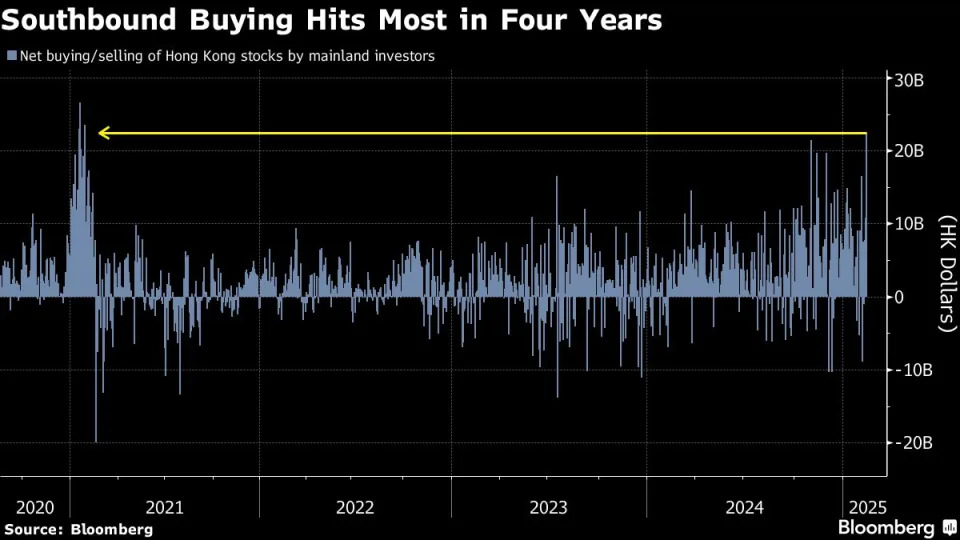

(Bloomberg) — Chinese mainland investors bought HK$22.4 billion ($2.88 billion) worth of Hong Kong stocks on Tuesday, as they continued to drive a DeepSeek-spurred tech rally in the city.

The inflow was the biggest daily purchase since early 2021 and the fourth largest on record, according to Bloomberg-compiled data going back to late 2016, when trading links with the financial hub began. Southbound investors bought another HK$5.5 billion on Wednesday morning, helping the Hang Seng Tech Index ( HSTECH.HK ) erase early losses of as much as 2.3%.

Their favorite security amid the frantic buying was the Tracker Fund of Hong Kong, of which they purchased over HK$9 billion. The inflows came even as the exchange traded fund saw mild outflows, suggesting non-mainland buyers were less enthusiastic.

The strong inflows into the city’s equities have reduced the premium between onshore and Hong Kong shares to around 34%. That’s close to a base that has historically triggered a rebound in the premium level, raising concerns that the outperformance of Hong Kong-listed Chinese shares over their onshore peers may narrow.

The last time mainland investors piled a record amount into the market and were deemed to have higher holdings of Hong Kong stocks, a gauge of Hong Kong-listed Chinese shares peaked shortly after.

(Updates with details throughout)