(Bloomberg) -- Treasuries advanced after a weaker-than-expected US producer prices report bolstered the case for the Federal Reserve to cut borrowing costs more aggressively this year.

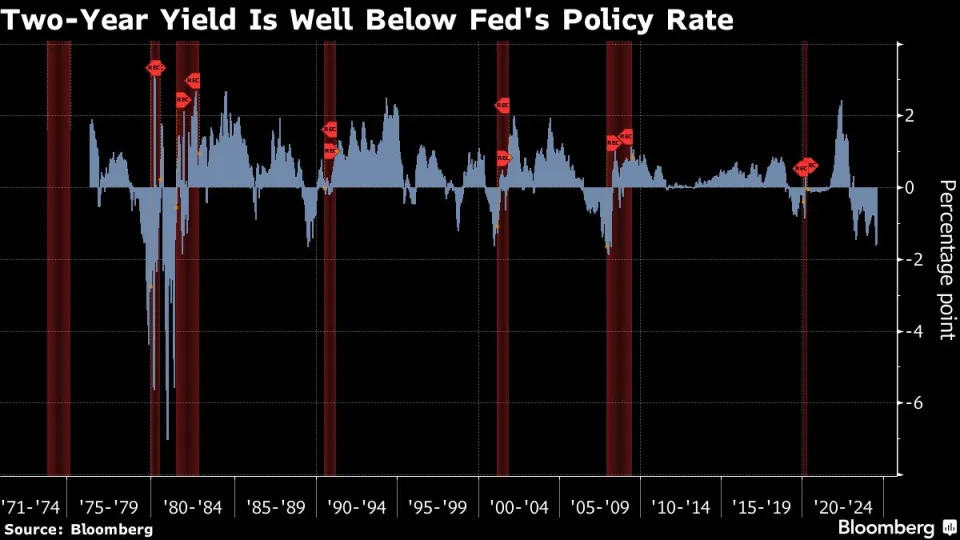

The inflation measure result came a day ahead of Wednesday’s crucial consumer price reading for July. Traders will be looking for signs of further easing in price pressures in that print. The bond market rose Tuesday pushing yields across the curve lower by at least four basis points. Two-year yields, which are more sensitive to expectations on the Fed’s policy, declined about 8 basis points to 3.94%. The 10-year yields fell 6 basis points to 3.85%.

“You can get a bit of relief here,” said Jack McIntyre, a portfolio manager at Brandywine Global Investment Management, following the softer PPI report.

The producer price index for final demand in July increased 0.1% from a month earlier, versus a gain of 0.2% in the median forecast of a Bloomberg survey of economists.

Earlier this month, a surprising rise in the unemployment rate fueled speculation that the Fed may start the easing cycle with supersized rate cuts and sent the two-year yields to the lowest since May 2023. The yields have since turned back up following more benign readings of data such as jobless claims and a rebound of risky assets.

“It reinforces the importance of data, and data will determine how the Fed will move,” McIntyre said. “But inflation is in the back seat to labor statistics right now.”

What Bloomberg strategists say...

“The move isn’t huge, which suggests that traders were expecting a slightly softer print than economists — and the same may apply to tomorrow’s CPI data.”

— Sebastian Boyd, Markets Live strategist. Read more on MLIV

Interest-rate swaps showed traders priced in 37 basis points of easing by the Fed at the September policy meeting and a total rate reduction of 107 basis points for the year. When the weaker-than-expected payroll report was released on Aug. 2, the market had penciled in a total of 117 basis points of rate cuts for 2024.

Some Fed officials have been pushing back against the markets’ aggressive expectations of easing, saying central banks shouldn’t overreact to just one job report.

On Tuesday, Atlanta Fed President Raphael Bostic said he’s looking for “a little more data” before supporting a reduction in rates. Fed Governor Michelle Bowman said on Saturday she still sees upside risks for inflation and continued strength in the labor market, signaling she may not be ready to support a rate decrease next month.

“Hawks are really leaning against doing anything right now,” wrote Neil Dutta, head of US economic research at Renaissance Macro Research. “The reality, at least right now, is that the Fed does not seem that anxious” and “something more drastic needs to happen in the economy or data to get their attention.”

The August jobs report is slated to be out on Sept. 6., less than two weeks before the Fed policy meeting. The central bank’s symposium later this month in Jackson Hole, Wyoming, will also provide an opportunity for Fed Chair Jerome Powell to fine-tune his message to the market on monetary policy.

The wild Treasury moves over the past few weeks is reminiscent of the roller coaster ride bond investors have endured this year. Treasuries steadily sold off in the first four months of 2024 as the resurgence of inflation disappointed investors looking for deep rate cuts.

Since then, data showed inflation is cooling and the labor market is softening, giving bond bulls an upper-hand. A JPMorgan Chase & Co. survey showed that their clients reduced their short positions in the week through Monday and shifted to neutral, That left the net long positions — or the difference between those investors who are bullish and those who were bearish — to the highest this year.

“We’ve gone from soft-landing in the beginning of the year, to no-landing, to hard-landing now,” said McIntyre, referring to rate-market expectations. “It’s an incredible amount of volatility. Volatility is not over yet.”

(Updates prices and add more context throughout.)