Bitcoin {{BTC}} has quickly recovered to nearly $60,000 after a debacle last week that saw prices drop below $50,000 at one point.

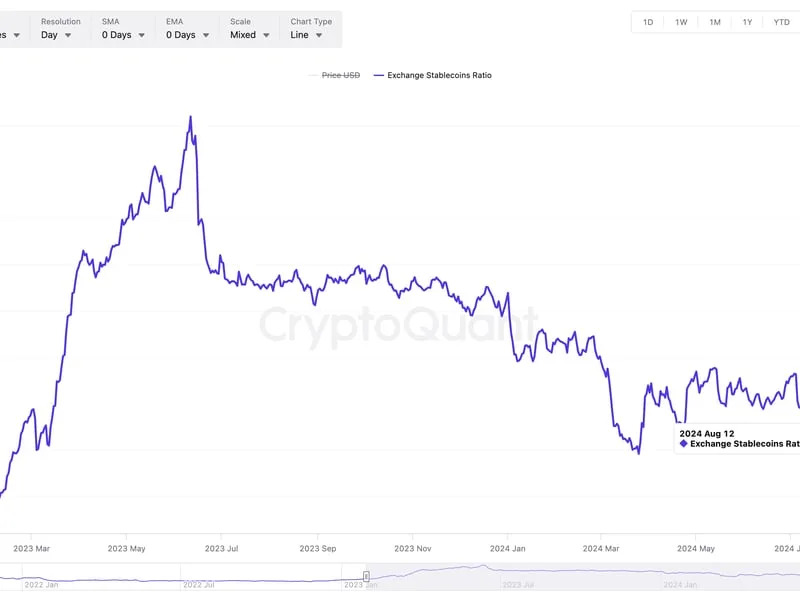

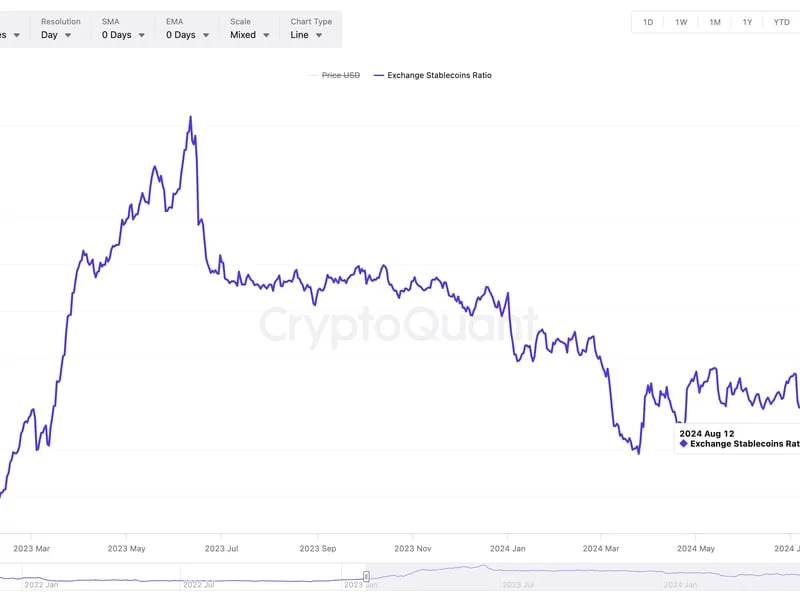

The recovery may have legs, as the "exchange stablecoins ratio," which measures the number of BTC held in wallets tied to centralized exchanges relative to stablecoins, suggests reduced selling pressure.

The ratio has dropped to its lowest since February 2023, extending a prolonged downtrend that began in June last year, according to data tracked by blockchain analytics firm CryptoQuant.

"This could indicate reduced selling pressure on bitcoin as fewer traders are converting their BTC into stablecoins," CryptoQuant told CoinDesk in a Telegram chat.

"Additionally, this could suggest a bullish market sentiment, where traders seem to be holding BTC in anticipation of future price increases," CryptoQuant added.

Stablecoins are cryptocurrencies with values pegged to an external reference such as the U.S. dollar. These digital assets help investors bypass price volatility associated with other tokens and are widely used to fund spot crypto purchases and derivatives trading.

According to charting platform TradingView, the combined supply of the top two stablecoins by market value, tether (USDT) and USD Coin (USDC), has increased by roughly $2 billion to $150.15 billion since the Aug. 5 market crash. On a year-to-year basis, the combined supply of USDT and USDC has increased by almost 30%.

It shows continued fiat inflow into the market, possibly from bargain hunters looking to snap up BTC at cheaper valuations.

The development is consistent with the constructive outlook offered by some analysts.

"Spot ETFs saw positive net flows on Monday. BTC (+$28M) and ETH(+$5M) saw institutional support after the weekend dip. This shows a certain resilience during times of fear, potentially helping Bitcoin’s volatility to decrease over the long term. Yesterday, the $58,500 level we mentioned held strongly and Bitcoin pushed above $60,500 before coming back to $59,500," Valentin Fournier, analyst at digital assets research firm BRN , told CoinDeks in an email.

The momentum is low but remains positive, as we predicted. We see Bitcoin getting closer to the upper trend of its range ($67,000-$69,000) in the coming weeks," Fournier added.