This article originally appeared in First Mover , CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day .

Latest Prices

CoinDesk 20 Index: 1,900 −1.6% Bitcoin (BTC): $58,871 −1.5% Ether (ETH): $2,644 −1.0% S&P 500: 5,344.39 +0.0% Gold: $2,463 +0.0% Nikkei 225: 36,232.51 +3.45%

Top Stories

The digital asset market was muted after crypto went unmentioned during the X space between Elon Musk and Donald Trump . BTC traded at around $58,750 during the European morning, down just over 1% from its price of 24 hours ago. The broader crypto market, as measured by the CoinDesk 20 Index (CD20), dropped by a similar amount. The two-hour interview between the X owner Elon Musk and the Republican presidential candidate attracted over 1 million listeners and was highly anticipated by the crypto community, but cryptocurrency didn't come up. On Polymarket, bettors priced a 65% chance of "crypto" being mentioned with over $600,000 in stakes on the topic.

One bitcoin analyst sees renewed losses in the short term, with the price falling by $5,000 from the going market rate of around $58,500 . "Bitcoin is likely to fall by $5K rather than rise by the same amount," Alex Kuptsikevich of FxPro said in an email. Kuptsikevich's bearish take stemmed from bitcoin's failure to keep gains above $60,000 in the wake of the death cross, a bearish crossover of the 50- and 200-day simple moving averages. "Bitcoin does not break above $60K and faces selling after it tried to break above the 50- and 200-day MAs late last week, showing seller dominance," Kuptsikevich noted. He added that the 14-day relative strength index (RSI) no longer shows oversold conditions, which means scope for another leg lower, consistent with the recent seller dominance above $60,000.

Data from SoSoValue shows that daily net inflow into the U.S.-listed spot ether ETFs hit $4.93 million on Monday . Grayscale's two funds posted no flows, while Fidelity's FETH hit $3.98 million in inflow, Franklin Templeton's EZET posted $1 million, and Bitwise's ETHW clocked $2.86 million in positive flow. VanEck's ETHV was the only one that posted an outflow of $2.92 million. Meanwhile, bitcoin ETFs posted a collective daily inflow of $27.87 million. Of the lot, Grayscale's GBTC had an outflow of $11.7 million, while Bitwise's BITB had an outflow of $17 million.

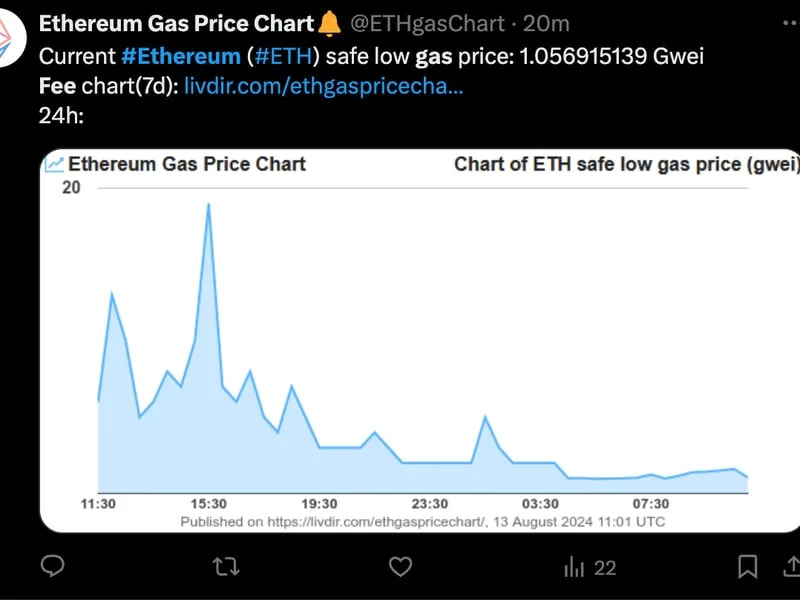

Chart of the Day

- Omkar Godbole