(Bloomberg) -- Chile’s central bank will likely pause interest rate cuts for the first time since July while signaling it could resume easing again later after policymakers weather a short-term jump in inflation.

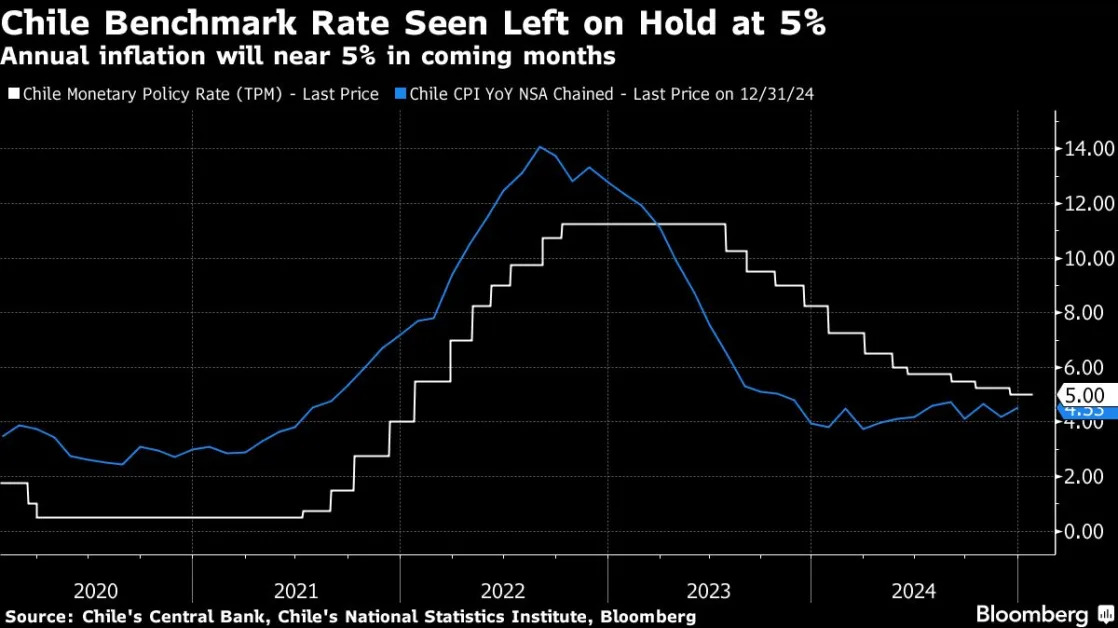

Board members will keep borrowing costs unchanged at 5% after markets close Tuesday, according to all economists in a Bloomberg survey. Investors are much more divided on how long rates will stay at that level after they tumbled from a post-pandemic high of 11.25% in mid-2023.

Central bankers led by Rosanna Costa will be looking to thread the needle on a complex cost-of-living outlook in one of Latin America’s richest economies. A weaker peso and another hike in local electricity tariffs will keep inflation near 5% in the first half of this year, well above the 3% target. Going forward, however, subdued demand and confidence levels will damp price growth.

What Bloomberg Economics Says

“We expect Chile’s central bank to keep its benchmark rate at 5.0% at its Jan. 28 meeting. Forward guidance is likely to remain cautious and emphasize future decisions will depend on new data and that any cuts will be gradual. Inflation in line with central bank forecasts, weak growth and increasing economic slack may convince policymakers to resume slow rate reductions in March. Persistent services inflation, external uncertainty and currency volatility are risks.”

— Felipe Hernandez, Latin America economist

Chile’s rate decision will be published on the central bank website at 6 p.m. local time in Santiago with a statement from the board. Here’s what to watch out for:

Near-Term Concerns

Investors expect Chile’s central bank to pull no punches when it comes to current inflationary risks. Earlier in January, the peso touched the weakest level since mid-2022, stoking fears of higher prices of imports.

Energy bills will become 10% more expensive on average starting this month as regulators raise tariffs that had been frozen following social unrest in 2019.

US President Donald Trump’s pledges for tax cuts and trade tariffs, coupled with expectations that the Federal Reserve will pause its own easing cycle, point to a stronger dollar globally.

Put together, central bankers will acknowledge that Chile’s medium-term consumer price outlook has worsened.

Traders now see annual inflation at 4.15% in 12 months, up from 3.5% before the central bank’s December interest rate decision. They don’t see odds of more borrowing cost cuts until the second half of this year.

Economic Growth

Analysts will parse policymakers’ comments on local economic growth. Any emphasis on unsteady activity would point to more rate cuts sooner rather than later, though a lack of detail would indicate the opposite.

“While we no longer see room for rate cuts this year, we lean towards the central bank continuing to signal softer demand-side inflationary pressures in the medium-term that would support rates below their current levels over the two-year policy horizon,” Banco Itau economists including Andres Perez wrote in a note.

--With assistance from Giovanna Serafim.