President Donald Trump wasted no time reviving a campaign he waged during his first term: Trying to browbeat Federal Reserve Chair Jerome Powell and other Fed officials into lowering interest rates.

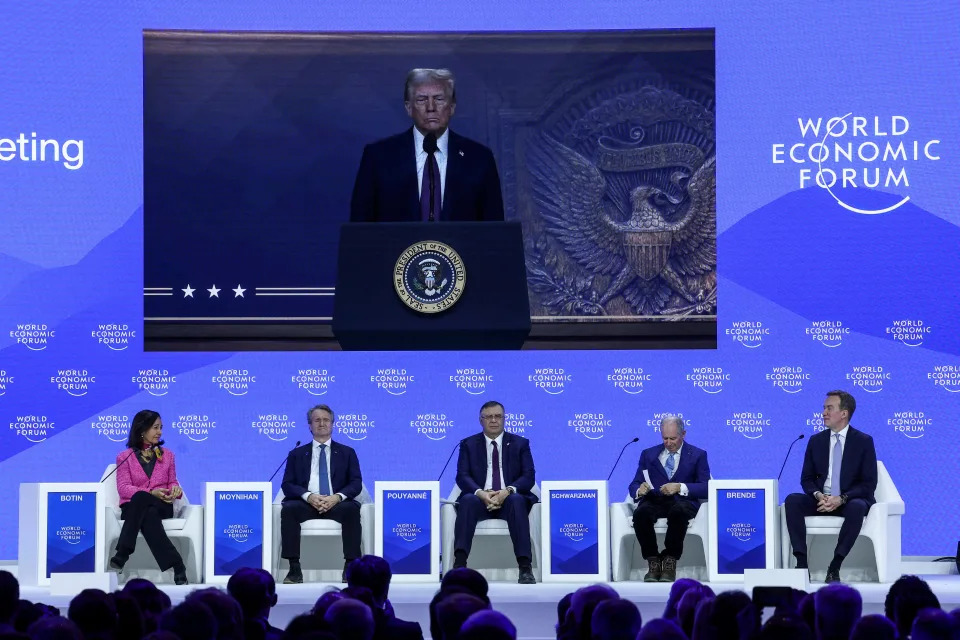

Economists said remarks such as those Trump made Thursday via a video call at the World Economic Forum in Switzerland threaten to compromise the Fed’s independence and could backfire by stirring inflation fears that wind up pushing long-term rates higher.

Arguing that Saudi Arabia and OPEC should take steps to lower oil prices, Trump added, “With oil prices going down, I'll demand that interest rates drop immediately.”

Trump’s comments stopped short of badgering the Fed into cutting rates now and instead amounted to speculation that a drop in oil prices would further ease inflation and lead the president to call for lower rates, said Barclays economist Jonathan Millar, a principal economist at the Fed from 2004 to 2018.

Still, during last year’s presidential campaign, the Wall Street Journal , among other news outlets, reported that Trump advisors were drafting a proposal to erode the Fed’s traditional independence by allowing the president to be consulted on interest rate decisions.

Trump’s comments also echo those he frequently made in his first term aimed at pressuring the Fed into cutting rates.

Does the president control the Fed?

The Fed long has been considered insulated from political forces so it can make interest rate decisions based on what’s best for the economy. The Fed cuts rates to juice a flagging economy and job market. It raises rates to lower inflation or prevent a spike in prices.

A U.S. president, by contrast, may seek to reduce rates to bolster the economy and boost his or her election chances or those of other lawmakers in his party.

Asked about his remarks later Thursday by reporters in the Oval Office, Trump said, “I think I know interest rates much better than they do.

“And I think I know it certainly much better than the one who's primarily in charge of making that decision,” he added alluding to Powell. “But no, I'm guided by them very much, but if I disagree, I will let it be known.”

When asked if the Fed would listen to him about wanting to bring interest rates down, Trump said "yeah." Asked if he would meet with Powell about bringing the rates down, he said, "At the right time, I would."

Why did the Fed cut interest rates?

After hiking rates sharply to fight a pandemic-induced inflation surge, the Fed cut rates by a percentage point the second half of last year as annual price increases eased substantially. But in December, the Fed forecast two quarter-point rate cuts in 2025 after inflation readings were higher than expected and the labor market remained sturdy, providing less urgency for the Fed to chop rates.

Futures markets expect the Fed to reduce its key interest rate by a quarter point in both June and December while Barclays expects just one rate cut in June.

The central bank previously predicted four rate decreases this year. The Fed next meets Tuesday and Wednesday.

Fed officials have signaled their projections for fewer cuts were based at least partly on Trump’s plans to impose big tariffs on imports from Canada, Mexico and China and deport millions of immigrants who lack permanent legal status. Hefty tariffs are likely to be passed along to consumers through higher prices and deporting immigrants likely would trigger labor shortages that spur larger wage and price increases, economists say.

Millar said he doesn’t believe Trump’s comments on rates would influence Fed decision-making. Still, he said, “It does raise real questions in terms of the Fed’s independence.”

If the Fed does lower rates sooner than expected, investors may wonder if officials were prodded to do so by Trump. And if they don’t, it also could raise concerns that policymakers held off to demonstrate their independence rather than for economic reasons.

“The perception matters,” Millar said.

“It is obviously a problem for central bank independence,” said Francesco Bianchi, an economics professor at Johns Hopkins University who studies the effects of political agendas and monetary policy on asset prices.

Ironically, if investors worry that the Fed could be affected by Trump’s wishes to lower rates, that could stir inflation fears that push up long-term rates, such as for mortgages, Bianchi and Millar said.

Powell repeatedly has said the Fed is unaffected by political factors. His term as chair ends in May 2026 and he has said the law would not allow Trump to replace or demote him.

Contributing: Swapna Venugopal Ramaswamy, USA TODAY

This article originally appeared on USA TODAY: Trump says he'll demand lower interest rates immediately