(Bloomberg) -- Oil tanker rates jumped on Monday as the Biden Administration’s sanctions on Russia’s petroleum trade threaten to cut the supply of ships while forcing traders to seek alternative sources of crude.

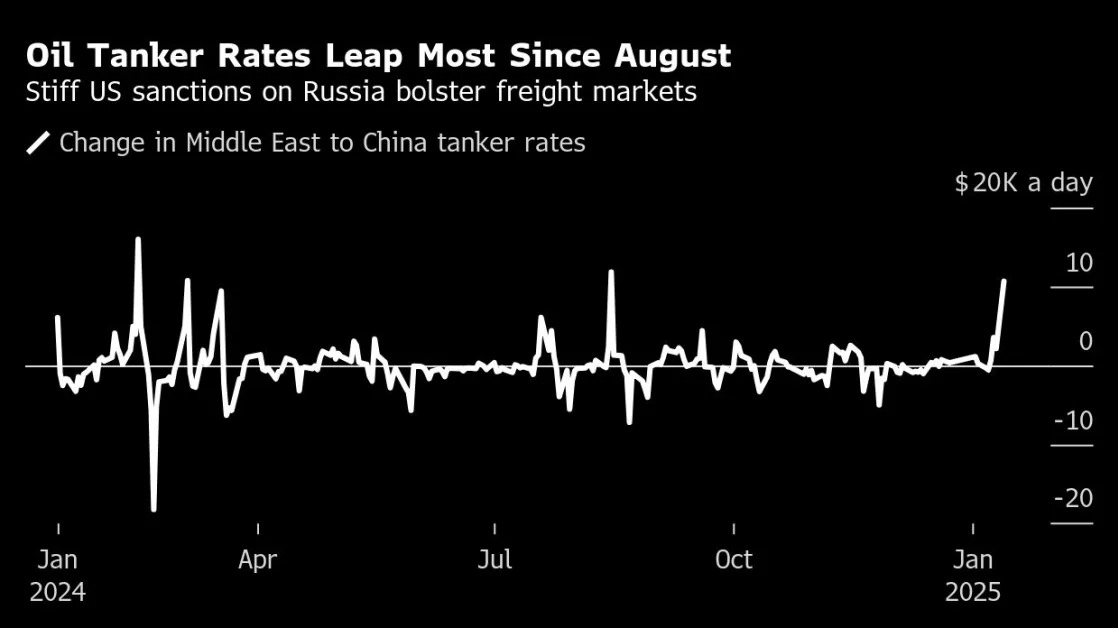

On Friday, ten days before Donald Trump takes over, the outgoing president sanctioned about 160 Russian oil tankers. It means about a tenth of the current crude-carrying fleet is under US measures. Benchmark tanker rates jumped 39%, the most since August, tracing a rally in shares of the world’s largest pureplay owners of the ships.

The hike is just one example of how the sanctions — the most aggressive by any western power since the war in Ukraine began — are threatening to disrupt Russia’s petroleum supply chain. The vast majority of tankers sanctioned by the US in previous rounds haven’t loaded any cargoes since then, and the sweeping scale of the latest move has driven a more than $4 a barrel increase in Brent crude futures.

Even before Friday’s sanctions, refiners in India and China had been hurriedly seeking barrels of Middle Eastern oil on worries about potentially lost supplies from Russia and also Iran. On Monday, a senior official in India said the country plans to reject oil tankers sanctioned by the US, highlighting another potential pull on the pool of unsanctioned vessels.

“There is a path for markets to strengthen materially on the back of the new vessel sanctions,” Anoop Singh, global head of shipping research at Oil Brokerage wrote. “A necessary condition for freight rates to surge would be the forced idling of the sanctioned fleet. Precedent supports that outcome.”

The widespread blacklisting came on the back of repeated targeting of ships hauling Iranian oil, further pressuring some tankers’ ability to keep trading and effectively hitting fleet supply.

New Ships

The risk of disruption to the freight market has been made more acute by a lack of new ships being delivered to the market.

With the so-called shadow fleet keeping vessels employed for longer, the “compliant” crude tanker fleet hasn’t expanded since 2022, according to the boss of Frontline Management AS.

It’s against that lack of growth that the oil-tanker industry has been looking at the impact of previous tanker sanctions. Ship-tracking data compiled by Bloomberg show 33 out of 39 tankers designated haven’t moved cargoes since falling under US measures.

Shares of Frontline surged more than 10% on Friday and continued to rally on Monday. Other listed tanker businesses including DHT Holdings Inc., International Seaways Inc. and Okeanis Eco Tankers also followed up significant gains on Friday with a further rally on Monday.

Short-haul oil deliveries from Russia’s eastern ports to China could have to be switched with flows from the Middle East which would require much longer sailing distances, Braemar Plc analysts including Henry Curra and Yiling Yi wrote in a note.

“OFAC sanctions are the only ones that genuinely restrict the employment of the vessel,” they said. “These sanctions will bite.”

Despite bullish rhetoric, there’s yet to be the kind of spike that followed when the US sanctioned China’s largest shipping company in 2019, propelling benchmark earnings to $300,000 a day. On Monday, they were still far below that level at $37,822, according to the Baltic Exchange.

Trump Response

Still, it remains unclear how President Trump will approach the measures when he takes office next week, and it’s likely that Russia will try to find ways to work around any restrictions.

If India seeks replacement barrels, it’s possible they’ll be from closer sellers than Russia, also limiting a boost to rates. A loss of cargoes from two sanctioned exporters, were that to materialize, could also be bearish.

But in recent months, a significant chunk of the global shipping fleet has been sanctioned, heightening the risk to trade.

Clarksons Securities AS estimates that about one in ten crude-carrying tankers are now under US sanctions. Earnings could top $100,000 a day this year, analysts including Frode Morkedal said, a level they’ve not hit since late 2022.

“For tankers, I think the most important part is the changing narrative on the dark trade,” said Jon Nikolai Skaaland, an analyst at SEB AB. “The US seems eager to punish Russia and Iran.”

--With assistance from Julian Lee.