Stocks are aiming for a third straight session in the green as 2025 gets under way, but after two straight 20%-plus up years for the S&P 500, there’s plenty of caution to go around.

Our call of the day from Dan Niles, founder of Niles Investment Management, is among the wary, forecasting a potential big drop for stocks ahead and making cash his top pick for 2025.

“My range of possible outcomes for 2025 of +10% (inflation contained & earnings grow 10%) to down 20% (inflation picking up & market multiples compress) is one of the widest I can remember,” the portfolio manager wrote in a X post , of his S&P 500 predictions.

Niles notes cash was his top pick in 2022, when the S&P 500 declined 19%. “Money-market funds (MMFs) currently offer a guaranteed yield of 4%. Given my concerns about 2025, I believe this is a solid guaranteed return which also leaves dry powder if the market sells off,” he said.

Money-market funds invest in cash-type instruments such as 3-month Treasury bills BX:TMUBMUSD03M to help shield from market swings. The yield on the 3-month T bill is just under 4.3%, though was above 5% for much of 2024.

“My largest concern is about inflation reigniting in late 2025 and the Fed needing to raise rates due to a strong U.S. consumer and pro-growth U.S. fiscal polices which are also inflationary. Therefore my goal is to remain adaptable to the markets reaction to incoming data in 2025,” he wrote.

Niles sees a near 50% chance that the Fed will either hold or raise interest rates by late 2025. “As a result, much like in 2022, investors may be looking at losses in both stocks and bonds if fears of a 1970s resurgence in inflation arise,” he wrote.

A year ago, Niles predicted a 20% gain for the S&P 500, provided the Fed could manage a soft landing, which he says got done, leading to a 23% finish for the index.

He sees stocks as expensive, noting the trailing price/earnings ratio for the S&P at 25 times versus 19 times historically. “A good portion of the multiple premium versus history can be accounted for by 10-year Treasury yields at 4.6% versus 5.8% historically when CPI is this high,” said Niles.

Niles cautioned that yields could go even higher if the incoming administration of President-elect Donald Trump tries to issue more longer-dated Treasury debt, pressuring stock-market multiples.

Read: Stocks appear ‘rate sensitive once again’ as bond yields press higher

He’s also wary on first-quarter 2025 company guidance when fourth-quarter earnings season begins next week. Among his concerns: potential for ad falloff from “the most expensive U.S. election in history in Q1 and no Olympic benefit” this year; a late Easter, weighing on first-quarter consumer and ad spending; and a strengthening dollar in late 2024, as 30% of the S&P gets revenue from international markets.

Read: Dollar bulls got a taste of volatility on Monday — and more may be in store

Other possible tripping points for stocks include inflation risks from potential moves on immigration, tariffs, tax-cut extensions and deregulation by the new administration. He also sees a “digestion phase” for AI by mid 2025.

The rest of his 2025 picks? Cisco SystemsCSCO, which could “rerate higher as 2025 becomes the year to network the enormous data created by AI infrastructure investment.” And banks via the Invesco KBW Bank ETF KBWB, which could benefit from a less regulatory environment, and midcaps via the iShares S&P Mid-Cap 400 Value ET IJJ, as a defensive play and beneficiaries of new U.S. policies.

Lastly, he sees a potential boost for networking and communications equipment provider ADTRAN Holdings ADTN due to improved macro conditions and increased fiber spending.

The markets

Stocks DJIA SPX are mostly higher, but the Nasdaq COMP is struggling, with Tesla down. Treasury yields BX:TMUBMUSD10Y are up and the dollar DXY is softer. Follow MarketWatch’s live blog for more.

|

Key asset performance |

Last |

5d |

1m |

YTD |

1y |

|

S&P 500 |

5975.38 |

1.16% |

-1.28% |

1.59% |

25.44% |

|

Nasdaq Composite |

19,864.98 |

1.94% |

0.65% |

2.87% |

33.83% |

|

10-year Treasury |

4.625 |

4.90 |

40.00 |

4.90 |

60.98 |

|

Gold |

2651.2 |

1.19% |

-1.19% |

0.45% |

30.34% |

|

Oil |

73.35 |

3.12% |

7.63% |

2.06% |

3.43% |

|

Data: MarketWatch. Treasury yields change expressed in basis points |

|||||

For more market updates plus actionable trade ideas for stocks, options and crypto, .

The buzz

Nvidia shares NVDA are poised for a fresh record high after CEO Jensen Huang’s keynote presentation, with a bigger boost for Micron MU after he said the chip maker will provide memory for Nvidia’s new Blackwell gaming chips .

Aurora Innovation stock AUR is surging after the autonomous-trucking tech group said it’s partnering with Nvidia and parts supplier Continental XE:CON. Uber UBER got a bump after announcing it’s also working with Nvidia.

Tesla stock TSLA is down after Bank of America analysts downgraded shares from buy to neutral.

Shares of online used-auto retailer Carvana CVNA are up after an upgrade from RBC Capital, days after being targeted by a short seller.

The Institute for Supply Management services index and job openings data are due at 10 a.m.

Best of the web

EV ‘battery belt’ towns bet Trump won’t ditch them .

What we know about HMPV, the virus spreading in China .

The extreme valuation gap between U.S. and European stocks.

The chart

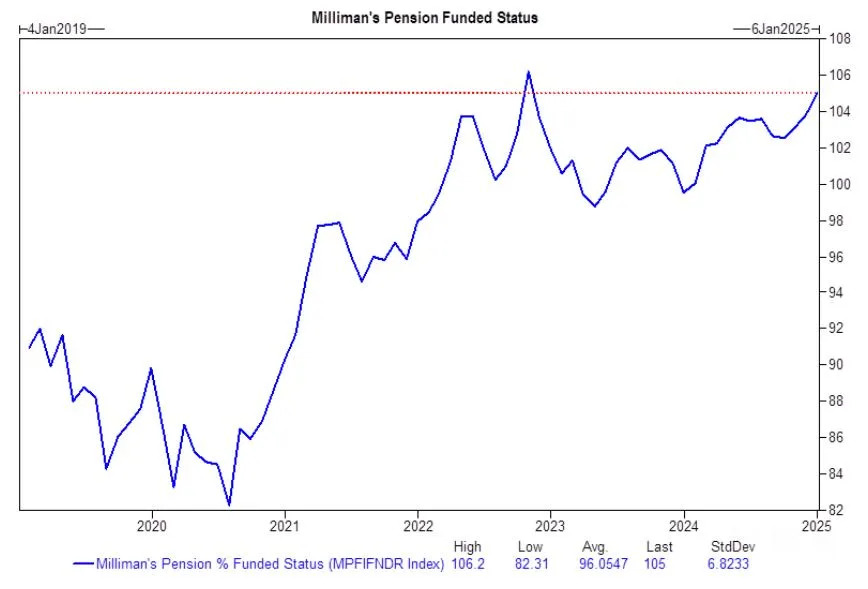

Pension funds are increasingly well funded, giving them an incentive to switch from stocks to bonds . Goldman Sachs tactical strategist Scott Rubner said the bank’s model estimates those funds likely had around $19 billion of stocks to sell at quarter-end, ranking in the 84th percentile over the past three years in absolute value terms.

Top tickers

These were the most active stock-market tickers on MarketWatch as of 6 a.m.:

|

Ticker |

Security name |

|

TSLA |

Tesla |

|

NVDA |

Nvidia |

|

GME |

GameStop |

|

XTIA |

XTI Aerospace |

|

FUBO |

FuboTV |

|

AMD |

Advanced Micro Devices |

|

PLTR |

Palantir Technologies |

|

MSTR |

MicroStrategy |

|

PLUG |

Plug Power |

|

AAPL |

Apple |

Random reads

Denmark’s king to Trump: Greenland is not for sale.

Hero Kansas utility workers free frozen bobcat mama and cub .

Need to Know starts early and is updated until the opening bell, but to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Check out On Watch by MarketWatch , a weekly podcast about the financial news we’re all watching – and how that’s affecting the economy and your wallet. MarketWatch’s Jeremy Owens trains his eye on what’s driving markets and offers insights that will help you make more informed money decisions. Subscribe on Spotify and Apple .